Reinsurance

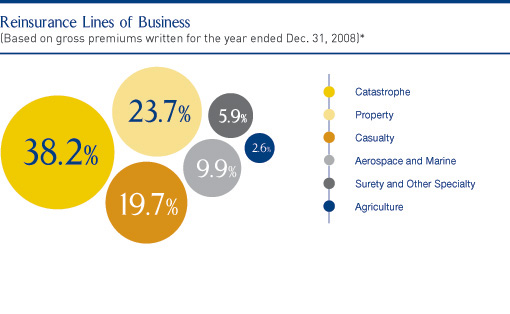

Reinsurance Lines of Business

CATASTROPHE

Reinsurance for catastrophic perils on a treaty basis for events such as hurricanes, typhoons, earthquakes, floods, tornados, hail and fire, as well as certain workers' compensation coverages.

PROPERTY

Proportional and excess of loss reinsurance of personal lines and commercial exposures.

CASUALTY

Reinsurance of automobile liability, professional liability, directors' and officers' liability, umbrella liability and workers' compensation insurance.

AEROSPACE AND MARINE

Reinsurance of aviation and space businesses, including aviation hull, aircraft liability and aircraft products coverages, as well as satellite launch and in-orbit coverage. Proportional and non-proportional reinsurance of bluewater hull, brownwater hull and cargo insurance business.

SURETY AND OTHER SPECIALTY

Contract and commercial surety reinsurance, on both a proportional and excess of loss basis, as well as personal accident and terrorism.

AGRICULTURE

Reinsurance of multiple peril, hail and named peril covers, as well as custom risk transfer mechanisms to provide protection from yield or price risk.

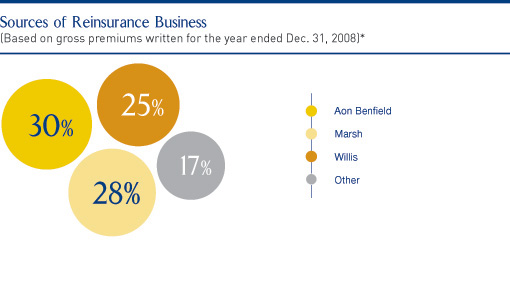

* Prior to deposit accounting adjustments.

Our worldwide reinsurance operation delivered a profitable year despite considerable dislocation in the capital markets and increased frequency of global catastrophe losses. A sustainable underwriting strategy based on specialty knowledge across our diverse product lines and disciplined technical underwriting continued to serve us well, as we strengthened our relationships with existing clients while forming valuable new ones. We expanded our global reach with branches in Zurich and Singapore, which improved our local market knowledge and gained us greater access to our clients and brokers in Europe and Asia.

We work closely with our clients and brokers, applying our advanced modeling techniques and underwriting knowledge to each and every opportunity. Consequently, our understanding of the unique characteristics of each client's portfolio allows us to make more informed business decisions and to better serve our clients' needs. Our specialty teams collaborate across products and geographies to deliver the exceptional service for which we are known.

While the turbulent economic climate has significantly weakened some competitors in our industry, the strength of Endurance's balance sheet and ratings, our track record of transparency and integrity, and our industry-leading risk management culture make us an attractive business partner.

We've built a solid foundation as we strive to become the best specialty reinsurer in the world. We are looking forward to serving our brokers and clients in 2009 and beyond.